Facts About Feie Calculator Uncovered

The Ultimate Guide To Feie Calculator

Table of ContentsSome Known Facts About Feie Calculator.Feie Calculator Can Be Fun For Anyone9 Easy Facts About Feie Calculator ShownGet This Report on Feie CalculatorThe Buzz on Feie Calculator

Initially, he marketed his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his other half to aid fulfill the Bona Fide Residency Test. Furthermore, Neil protected a long-lasting building lease in Mexico, with strategies to ultimately buy a home. "I currently have a six-month lease on a residence in Mexico that I can extend another six months, with the objective to buy a home down there." Nevertheless, Neil mentions that getting residential or commercial property abroad can be challenging without first experiencing the location."We'll certainly be beyond that. Even if we come back to the United States for physician's appointments or service phone calls, I question we'll invest more than 30 days in the United States in any kind of offered 12-month duration." Neil stresses the importance of stringent monitoring of united state sees (FEIE calculator). "It's something that people need to be actually thorough about," he says, and recommends expats to be cautious of typical blunders, such as overstaying in the united state

Indicators on Feie Calculator You Should Know

tax obligation obligations. "The reason united state tax on around the world income is such a huge bargain is because lots of people forget they're still subject to U.S. tax also after relocating." The U.S. is just one of the few nations that tax obligations its residents regardless of where they live, suggesting that even if a deportee has no revenue from U.S.

tax return. "The Foreign Tax Credit enables people working in high-tax countries like the UK to offset their U.S. tax responsibility by the amount they've currently paid in taxes abroad," states Lewis. This ensures that expats are not tired two times on the exact same income. Those in low- or no-tax nations, such as the UAE or Singapore, face additional hurdles.

A Biased View of Feie Calculator

Below are a few of one of the most regularly asked inquiries concerning the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers to omit approximately $130,000 of foreign-earned revenue from federal revenue tax obligation, minimizing their U.S. tax liability. To receive FEIE, you have to meet either the Physical Existence Examination (330 days abroad) or the Bona Fide Residence Examination (show your primary home in a foreign nation for a whole tax obligation year).

The Physical Existence Test additionally requires United state taxpayers to have both an international revenue and a foreign tax obligation home.

The 9-Second Trick For Feie Calculator

An earnings tax obligation treaty between the U.S. and one more nation can help prevent dual tax. While the Foreign Earned Revenue Exemption minimizes gross income, a treaty may give additional benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a required declare united state residents with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on conference details residency or physical presence examinations. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxes, cannabis taxes and divorce relevant tax/financial preparation issues. He is an expat based in Mexico.

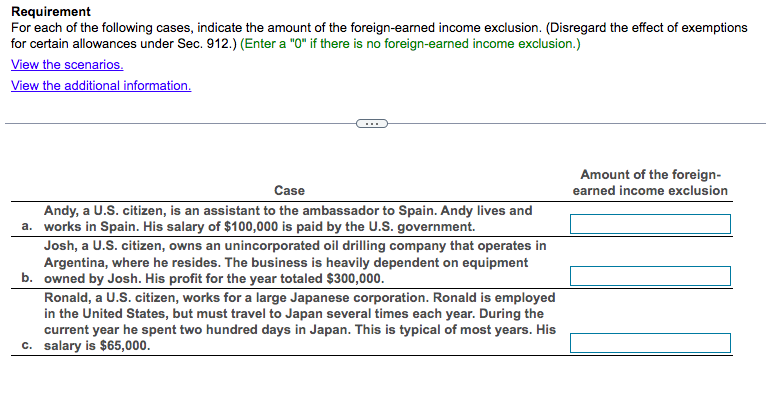

The foreign made anonymous earnings exemptions, often referred to as the Sec. 911 exclusions, leave out tax obligation on earnings made from working abroad.

The Definitive Guide to Feie Calculator

The tax obligation benefit excludes the earnings from tax obligation at bottom tax rates. Previously, the exclusions "came off the top" lowering earnings subject to tax at the leading tax rates.

These exclusions do not spare the incomes from United States tax but simply offer a tax decrease. Note that a single person functioning abroad for all of 2025 that gained about $145,000 with no other revenue will have gross income lowered to zero - efficiently the same response as being "tax cost-free." The exemptions are computed daily.